GENIUS Act Explained: How U.S. Stablecoin Rules Will Transform Crypto in 2025

In my experience covering crypto regulation, nothing has been this pivotal since the Terra collapse in 2022. The GENIUS Act, passed by the U.S. Senate on June 18, 2025, brings stablecoin regulation into the mainstream, targeting the $250 billion market with robust guardrails. If you’re a crypto investor—or just curious—this clear 1:1-backed framework is about to reshape the space.GENIUS Act Explained

What Is the GENIUS Act?

- Acronym: Guiding and Establishing National Innovation for U.S. Stablecoins

- Senate vote: Passed with 68-30 bipartisan support

- Next steps: Sent to the House, then to President Trump for signature

Key Pillars of the Legislation

1. 1:1 Reserve Backing & Audits

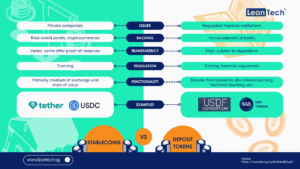

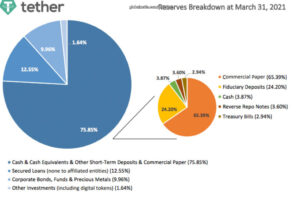

Issuers must hold equal value in U.S. dollars or Treasuries and publish monthly disclosures—large issuers need annual audits.

2. Consumer Protections & AML Compliance

Stablecoin holders get priority in bankruptcies, and issuers must follow anti-money-laundering rules.

3. Federal Licensing

Issuers register federally, with foreign entities allowed entry under U.S. rules.

4. Conflict-of-Interest Loopholes

The bill bans Congress members but excludes the President and family—critics flagged Trump-related conflicts.

Why This Matters

a. Dollar-Backed on the Blockchain

Issuers become major holders of Treasuries—potentially influencing yields—and solidifying the digital dollar ecosystem.

b. Traditional Finance Embracing Crypto

Companies like Circle, Coinbase, JPMorgan, Walmart, and Meta are already integrating stablecoins.

c. Public Company Momentum

Circle shares are up ~27% to $190 recently, while Coinbase rallied ~17% post-vote.

What I Learned (Personal Take)

I tried analyzing the balance between innovation and stability. What I learned is that this could be the foundational rulebook, not just for crypto but for traditional finance too—if they get the House to act fast.GENIUS Act Explained

Real-World Impacts So Far

- Circle: Stock surge, wider infrastructure plans

- Coinbase: Boost in stablecoin-driven revenueGENIUS Act Explained

- Banks & Tech: JPMorgan filed “JPMD”; giants like Walmart, Amazon exploring uses

FAQs — Common Questions

Q: When will it become law?

Must clear the House, then President signs—likely by late summer 2025.

Q: Will smaller stablecoins qualify?

Yes—all issuers, regardless of size, need backing and compliance measures.

Q: Could this destabilize banks?

Yes—funds may shift from banks to stablecoins, straining smaller banks.

Q: Global rival: China’s e‑CNY?

Yes—this boosts U.S.’s digital dollar credibility versus foreign CBDCs.

Recommended Resources

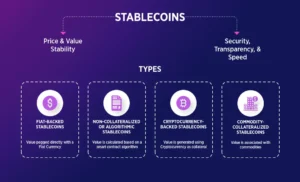

- What Are Stablecoins – Binance

- GENIUS Act Coverage – Coindesk

- Circle Official Website

- Read: How to Buy USDT in India

Final Thoughts & CTA

What’s your take on the GENIUS Act? Will it strengthen the digital dollar or create new risks? Let’s talk in the comments.

Disclaimer

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Fast Achieve Education or its partners. The content is for informational purposes only and should not be considered as financial or investment advice. Crypto markets are highly volatile. Please do your own research (DYOR) or consult a financial advisor before making any investment decisions.